Description

Better Then A Lease?

Why Consider a Non-captive Balloon Loan

A traditional balloon loan combines features of a lease, such as low payments based on a residual value, with features of a loan, such as direct ownership. This type of financing is sometimes offered by captive lenders, like BMW and Ford, who brand them “Select” or “Option” programs, and offer them alongside more traditional lease and conventional financing options.

However, here we focus on programs available from non-captive sources, most commonly credit unions reselling a program administrated by the Auto Financial Group (AFG). At minimum, these programs offer another marketplace option, which should be considered and shopped alongside captive programs. At best, given the right mix of market conditions and program terms they can offer compelling options superior to captive programs.

Benefits of a non-captive balloon loan

The biggest benefit of a balloon loan is the flexibility of multiple termination options. At the end of your loan term, you can either return the vehicle, and walk away, or you can keep the vehicle, by refinancing into a new loan product, at prevailing rates. Unlike a lease, a balloon loan is also titled and registered in your name. Other balloon loan benefits include:

- Finances a new purchase, capturing rebates only available to cash/retail.

- Finances a used purchase, including a loan refi or lease buyout.

- Permits transferring plates and registration, a savings in some states.

Example: Where a vehicle depreciates fast and underperforms RV

When faced with financing a vehicle which will most likely yield substantial negative equity over the loan term, the walk away option keeps your TCO fixed. Consider a short term (24/36mo) with no down payment and focus on finding a low monthly. This is good for many EVs or other heavily incented vehicles.

Example: Where a vehicle holds value well

When faced with financing a vehicle which will carry positive equity, the buy-out option lets you capture that equity at any time. Consider a long term (72mo) with no down payment and focus on finding a low monthly. This is good for rare vehicles, exotic vehicles or brands known for holding value (especially during COVD).

What Is the Downside of Using a Balloon Loan…

A balloon loan carries extra risk. In all cases, the sum of the payments doesn’t bring the loan balance to zero, and a final balloon payment is due. This can lead to hardship as you may be forced to return a vehicle, when you want to keep it, or face refinancing at prevailing rates, which may not be favorable. For most who are adept at managing finances, this risk is manageable, but unfortunately balloon loans have a bad reputation. Other risks to consider include.

- In most states, you will need to pay full sales tax upfront, so no tax advantages, like a lease. Consider using a trade-in to offset the tax balance.

- Balloon loans generally do not residualize options very well. The best build is a base trim level, not one with lots of options.

- The interest rate is usually one point higher versus conventional financing. I have been told the credit union collects this fee for insurance against the actual RV.

- Some credit unions may charge an extra origination fee for vehicles over $70K.

That’s right… Walkaway, like a lease

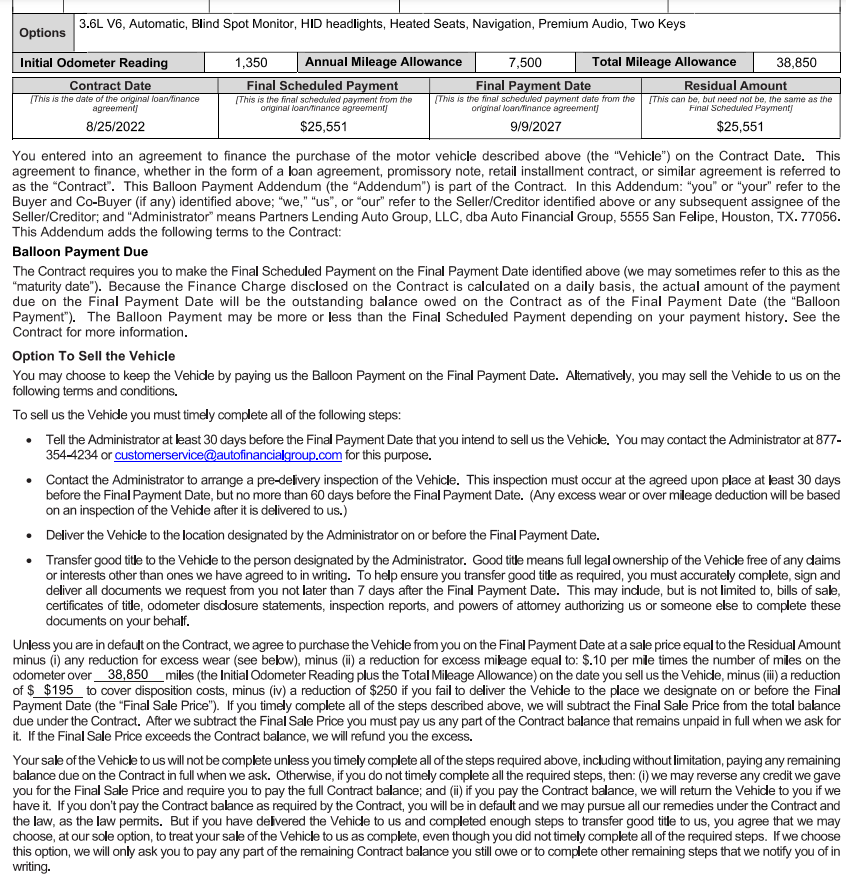

Every balloon loan includes a vehicle return rider. As the market changes, it can help to insulate oneself from potential depreciation. This return option requires paying a small disposition fee, and like a lease, also assess for any extra wear & tear. Here is an example, circa 2022, balloon loan contract used to illustrate how the return option works.

The Right Conditions for a Balloon Loan

Once you have decided that the risks of a balloon align with your personal financial strategy, the next step is to assess if your target vehicle is a good candidate. Not every vehicle will have a competitive program, in fact 96% of the time the program will suck. Research will be necessary to compare payments and total cost of ownerships across financing options. The best way to do this is the use one of the calculators, linked later in this article, and focus on finding

- A large gap between estimated retail value and purchase price.

- A favorable residual value. the closer to the purchase price the better.

Here are examples where I have used or suggested a balloon loan:

- Challenger, Dodge was still offering power dollar rebates with a purchase, but not with a traditional lease. Using the balloon loan qualified me for thousands in additional rebates versus a CCAP lease.

- Tesla M3, it’s about the ability to sell the vehicle, at any time, and not be forced to return it to Tesla. This allows me to recoup the equity locked in the vehicle, which would otherwise be lost w/ a Tesla lease.

- Dodge RAM TRX - Takes advantage of a favorable gap between purchase prices and MRM.

- Toyota Tacoma TRD Off Road V6 - Takes advantage of a strong RV for this brand and a reasonable MRM.

- 2023 Ford F-350 SRW XLT 6.7L - Combines MRM/purchase price gap with actual vehicle depreciation much greater than residual value forecast.

- 2023 MB EQS 580 SUV - Combines MRM/purchase price gap with actual vehicle depreciation much greater than residual value forecast.

Where can I get a balloon loan…

The most common institutional lender offering balloon loan programs is Auto Financial Group (AFG) and they do not offer the program direct to the public. Instead, the program is offered via affiliated credit unions. Thus, most credit unions who advertises a balloon loan offering are reselling the same AFG program. Some credit unions may call these programs something like “better then a lease” or “payment saver” and may charge different rates and/or fees – but they are all fundamentally the same. The below list provides suggested credit union offering this program.

- CapEd Credit Union (https://capedcu.com/) Payment saver auto loan product offered at moderate rates across various terms. A one-time donation to the CapEd Foundation permits membership. You can join and apply online, you will be assigned a loan officer who will follow-up over the phone. Can close quickly, great service.

- First Eagle Federal Credit Union (Flex Auto | First Eagle) Low rates with full access the AFG balloon loan portfolio via Flex Auto program offering. Membership is possible by joining their Financial Fitness Association. Must join as member first, before applying for auto loan.

- Park City FCU (Loan Rates - Park City Credit Union) New option offering low rates and backdoor membership by joining a supported non-profit organization. Hard to reach, no first-hand experience. Looking for more feedback.

- Hanscom Federal Credit Union (https://hfcu.org/) Better then a lease auto loan product offered at higher rates and few terms. A one-time donation to the Nashua River Watershed Association permit membership. You can join and apply online, you will be assigned a loan offer who will follow-up over the phoner. Charges extra fees.

Another institutional vendor, CULA, is often discussed as another option. However, it appears that these programs are only accessible to dealers and not the general public. These means to access these programs you must use a dealer from the network.

How Do I Use A Balloon Loan Calculator…

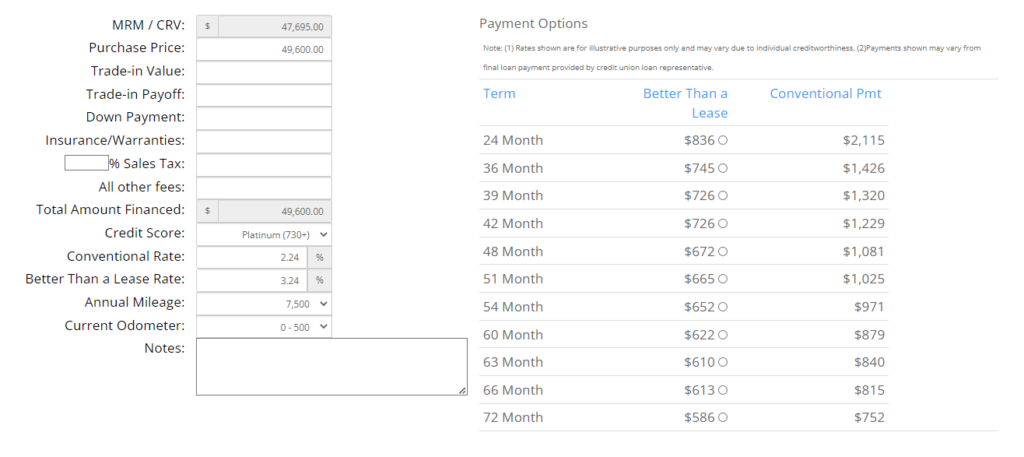

- AFG Default Payment Calculator AmeriCu Calculator Use this calculator first, to determine the loan balance, rate and payment for your preferred term. Here is what a calculator looks like setup for a Ford Mach-E purchase in NJ. Note that the lowest mileage option has been selected, since we will not be returning the vehicle.

- Balloon Loan Reverse Calculator Balloon Payment Loan Calculator |- MyCalculators.com Use this calculator second, take the data from the previous calculator and solve for the final balloon payment. Given the 24mo payment from the AFG calculator, we can solve for the final balloon payment…

Acronym’s & Terminology used in this wiki

MRM / CRV – This is the value of the vehicle assigned by AFG. It is based on the “Maximum Residualized MSRP”, which consists of the MSRP of the typically equipped vehicle and value adding options giving only partial credit or no credit for those options that ALG understands add little or no value to the resale price of the vehicle.

Purchase Price – This is the price you can purchase the vehicle from a dealer.

Down Payment – Upfront funds used to reduce the loan balance.

Total Amount Finance – The amount of the loan

Conventional Rate – The rate commonly offered on traditional finance.

Balloon Rate – The rate offered with the balloon product.

Annual Mileage – Mileage affects the residual value of the vehicle.

Residual Value – The forecast value of the vehicle at the end of the loan term.

Balloon Payment – The final payment due at the end of the loan term.

MMR – Manheim Market Report, the wholesale value of the vehicle at a given point in time.